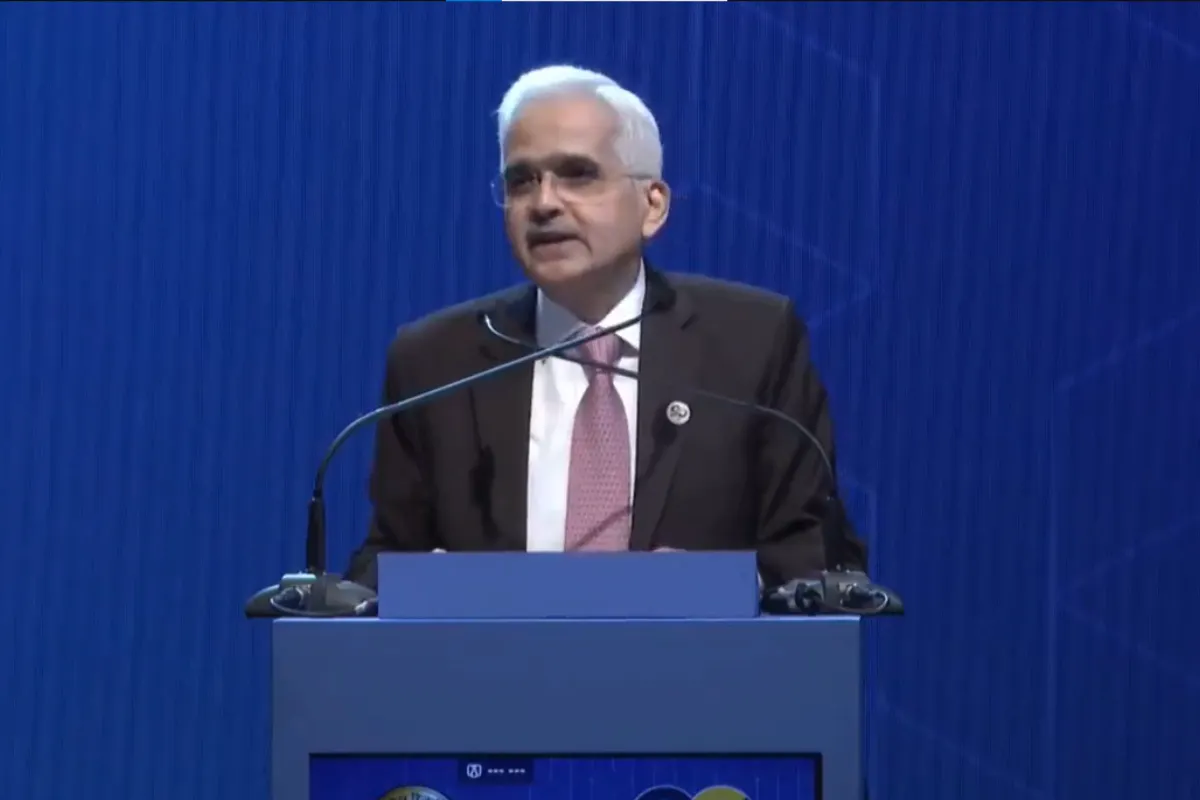

Launching its new platform for “frictionless credit” nationwide, the Reserve Bank of India (RBI) is poised to make a significant push towards digital financial infrastructure. At the Global Conference on Digital Public Infrastructure and Emerging Technologies in Bengaluru, RBI Governor Shaktikanta Das revealed the name of this technology, which was first unveiled as a pilot project last year. It is called the Unified Lending Interface (ULI).

The Next Big Leap – Unified Lending Interface (ULI)

Governor Das made comparisons between ULI’s potential to completely overhaul India’s lending sector and the revolutionary success of UPI (Unified Payments Interface). “Just as UPI has redefined how payments are made in India, ULI will similarly change how lending is accessed,” Das said with assurance. He underlined that this new platform will signify a major turning point in India’s digital path as it becomes a member of the “new trinity” of JAM (Jan Dhan-Aadhaar-Mobile), UPI, and ULI.

The purpose of ULI is to facilitate the easy and consent-based exchange of digital data, including land records from different states, between lenders and borrowers. The platform seeks to expedite the credit application process by enabling the rapid flow of information from various data sources, especially for small and rural borrowers.

Simplifying Credit Appraisal

The pilot phase of ULI has already shown promise in reducing the time taken for credit appraisals. Das highlighted that the ULI architecture is built with standardized APIs that allow for a ‘plug and play’ approach. This approach simplifies technical integrations for lenders and ensures that borrowers can access credit faster, with fewer hurdles and less paperwork.

Catering to Unmet Credit Demand

The goal of ULI’s digitisation initiatives is to link customers’ financial and non-financial data from disparate, previously unconnected sources. This could help fulfil the significant and frequently unmet demand for credit, especially in the MSME (Micro, Small, and Medium Enterprises) and agricultural sectors.

A Vision for India’s Financial Future

In light of UPI’s success, Das commended the present digital payments ecosystem for offering a safe and convenient platform for fast money transfers for both people and companies. ULI aims to achieve the same degree of efficiency and accessibility in the loan market.

Keep watching our YouTube Channel ‘DNP INDIA’. Also, please subscribe and follow us on FACEBOOK, INSTAGRAM, and TWITTER.