MOIL: Nestled under the Ministry of Steel, MOIL Ltd stands tall as the nation’s manganese mining leader, contributing a significant 45% to the domestic ore production. Beyond its mining prowess, this state-owned gem has recently dazzled investors with a remarkable 45% return in just two months. The question now echoes – is MOIL’s brilliance a fleeting flash, or could it be your golden ticket to financial prosperity in 2024? Let’s dig into why MOIL could be a great opportunity for smart investors.

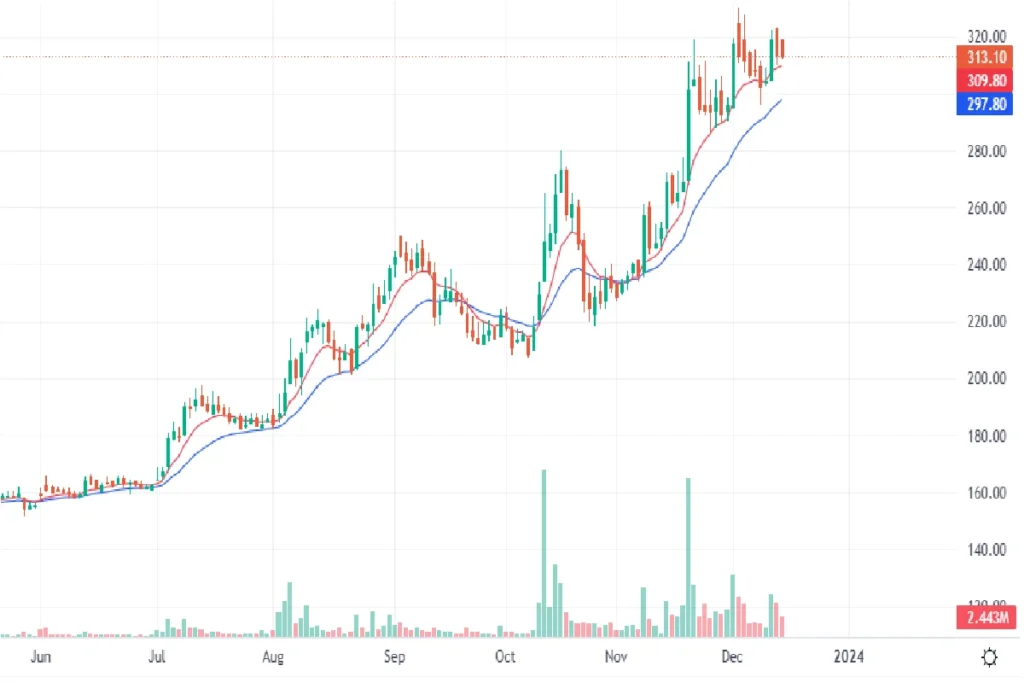

A Look at the Daily Chart

The daily chart of the stock unveils a compelling uptrend, characterized by consistently higher highs and higher lows.

In October 2023, the stock traded around 214 rupees per share, and by December, it surged to an impressive 315 rupees per share, providing investors with a remarkable 45% return within a brief two-month span. Upon closer inspection, the stock recently surpassed its all-time resistance point at 300 rupees, marking a significant breakthrough supported by a strong candle. The pivotal question now is whether this upswing is sustainable. If the stock manages to maintain its current levels, it opens the door to promising opportunities for investors.

MOIL’s Stellar Production Surge

MOIL’s stellar performance continues, with impressive growth in both production and sales. In November alone, manganese ore production soared 35% year-over-year, reaching 1.62 lakh tonnes. This translates to a remarkable 43% growth in the current fiscal year, with a total production of 10.9 lakh tonnes in the first eight months. Similarly, sales have witnessed impressive growth, rising 18% in November and 52% in the April-November period.

The company’s unwavering commitment to exploration is further evident in its significant increase in core drilling activities. November 2023 saw a two-fold increase compared to the same period last year, with a total of 7551 meters drilled. From April to November 2023, MOIL has effectively carried out 49,389 meters of core drilling, marking a 2.5-fold increase over the previous year.

Financial Resilience and Strategic Focus

Beyond the numbers, MOIL Ltd’s financial resilience is noteworthy. The company is almost debt-free, maintaining a healthy dividend payout of 53.9%. An improvement in debtor days from 51.2 to 39.1 days adds to the company’s financial stability.

Looking ahead, MOIL Ltd has set ambitious targets. It aims to enhance manganese production to 3 million metric tonnes by 2030. Simultaneously, the company explores diversification into related businesses and geographies to create additional value for shareholders.

Investing in MOIL: A Golden Opportunity?

With its impressive performance, robust financial health, and ambitious growth plans, MOIL Ltd. presents a compelling investment opportunity. The recent surge in stock price, coupled with strong fundamentals, paints a particularly optimistic picture. However, as with any investment, thorough research and careful analysis are crucial before making a decision. Consider consulting with a financial advisor to assess if MOIL aligns with your investment goals and risk tolerance.

Disclaimer: (This information is provided solely for informational purposes. It is important to note that investing in the market or a business idea involves market risks. Before investing money as an investor/ owner/ partner, always consult an expert. DNP News Network Private Limited never advises to invest money on stocks or any specific business idea. We will not be liable for any financial losses.)

Keep watching our YouTube Channel ‘DNP INDIA’. Also, please subscribe and follow us on FACEBOOK, INSTAGRAM, and TWITTER