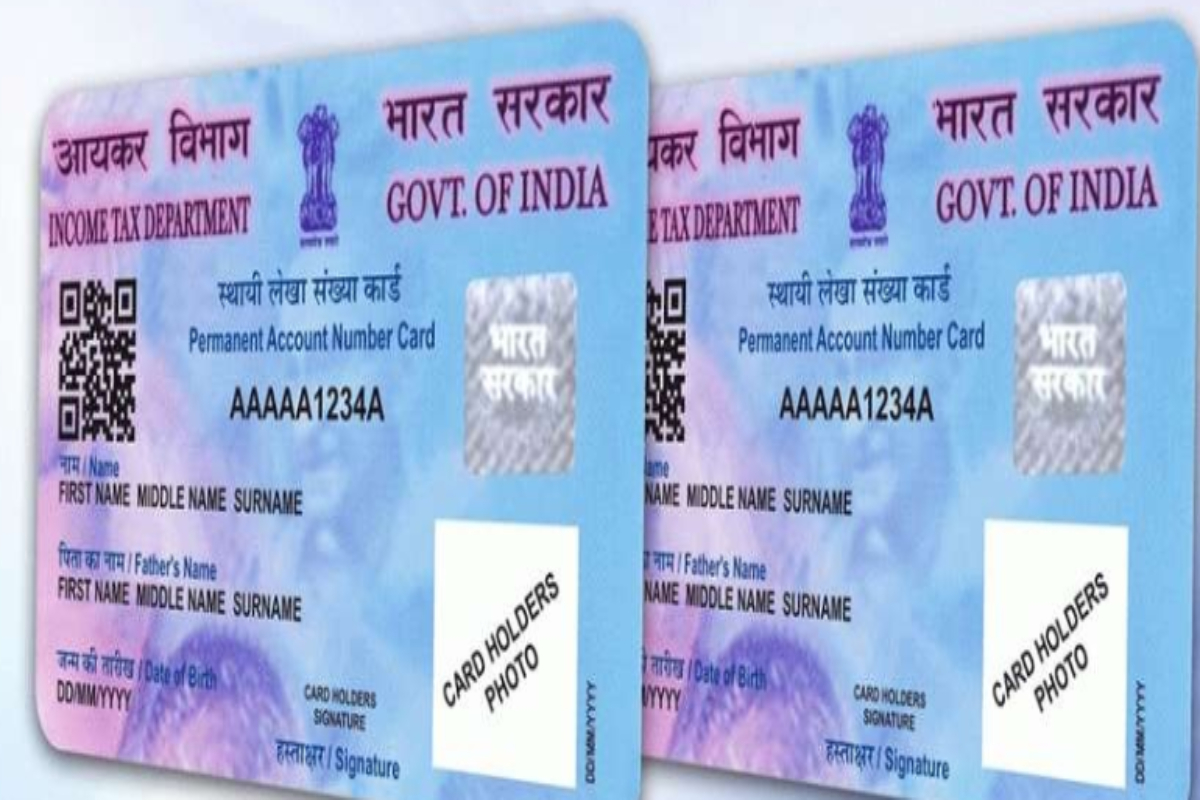

PAN Card Holders Alert: For all types of financial operations, the Permanent Account Number, or PAN Card, is a crucial document. Nearly everything requires a pen, but carrying one around can be a little dangerous. There is a dread of losing it, but if someone does get their hands on it, they should not abuse it. The PAN card is a crucial document that aids the Income Tax administration in keeping track of all financial transactions necessary to determine an individual’s or an organization’s tax due. This helps to lower the likelihood of tax avoidance. We must, however, bear a few things in mind. A person may be required to pay a fine of Rs 10,000 for a small infraction.

Important Rules to Follow

A person should only have one PAN card in addition to carefully filling out the 10 digits of information. Two PAN cards may result in a fine for the owner. In accordance with the law, the Income Tax Department will revoke the PAN card and issue a fine as penalty. Additionally, the bank account may be frozen if the PAN is inaccurate. In accordance with the established protocol, the second PAN card needs to be sent to the department right away. The Income Tax Department may impose a punishment of Rs 10,000 on someone who provides inaccurate PAN information. This clause is particularly crucial when submitting an Income Tax Return (ITR) form or in other circumstances when PAN card information must be included. Therefore, if you have two PAN cards, you should give the Income Tax Department one of them right away.

Step-by-Step Guide to PAN Card Application and Corrections

- Go to the website of IT department incometaxindia.gov.in

- Click on ‘Request for new PAN card/change’ or ‘Correction PAN data’

- Download the form, fill and submit it at any National Securities Depository Limited (NSDL) office

Keep watching our YouTube Channel ‘DNP INDIA’. Also, please subscribe and follow us on FACEBOOK, INSTAGRAM, and TWITTER