Sebi, in a circular, on Friday announced new set of portfolio allocation rules for multi cap mutual funds where the Market Regulator made it mandatory for the multi cap funds to invest a minimum of 25% of their portfolio each in large cap stocks, mid caps and small cap companies.

Multi cap equity funds invest in companies of all sizes and across sectors. Unlike large or mid cap funds, they can decide how money gets allocated between big, mid-sized, and small companies. This flexibility also allows them to make changes in the portfolio as market conditions change.

The other option AMCs would consider is converting multi-cap schemes into thematic schemes, which do not have investment restrictions. The last option would be to close down the multi-cap schemes and return the money to investors. These decisions will depend on Sebi’s approval.

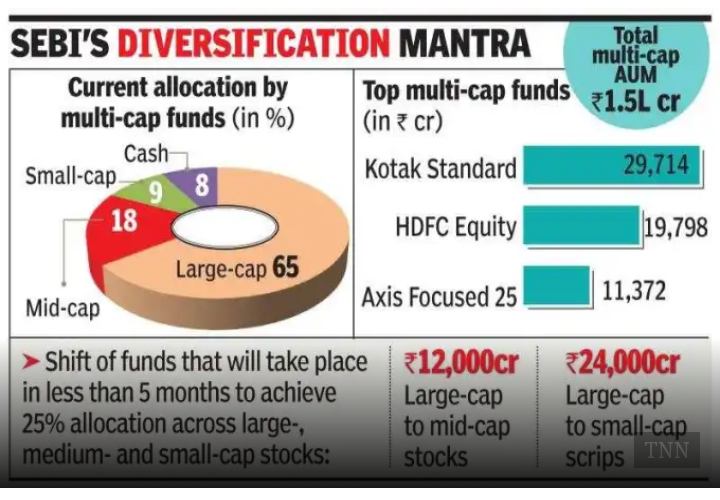

The move will force money managers to lower their exposure to largecaps and shift funds to the midcap and smallcap stocks, a move that could result in about Rs 35,000-40,000 crore shifting from largecaps to the broader market.

Fund houses are required to comply with the new norms by January 31, 2021. The rush to add smallcaps and midcaps to multicap portfolios could result in a run-up in those share prices.

“The move by the regulator is structural. As on August 2020, the assets under management (AUM) under multi-cap funds were around Rs 1.45 lakh crore. Of these, around 70-75 percent of the funds were invested in largecap stocks and rest in mid-smallcap stocks. So we are estimating around Rs 30,000-35,000 crore additional liquidity for the mid-smallcap space,” Choice Broking said.

As less than 10 percent of the multi-cap AUM is in smallcap companies, these categories will be flush with liquidity, it said.

Currently, daily volumes in mid-cap stocks is about Rs 11,700 crore, while in small-cap scrips it’s about Rs 4,800 crore. So a Rs 300-crore transfer per day works out to about 2% of the current daily turnover in these stocks.

Currently, Kotak Standard Multicap Fund is the largest in the lot with an asset base of Rs 29,714 crore, followed by HDFC Equity Fund at Rs 19,798 crore and Axis Focused 25 Fund at Rs 11,372 crore, industry data showed.