Ruchi Soya FPO: The follow-on public offer (FPO) of Baba Ramdev’s company Patanjali Backed Ruchi Soya was opened since previous week. This FPO is about Rs 4,300 crore. Ruchi Soya’s FPO opened for subscription on March 24. Notably today is the the last date to subscribe to this issue.

The follow-on public offer of Ruchi Soya Industries has been subscribed 1.4 times so far as the FPO garnered bids for 6.86 crore equity shares against the size of 4.89 crore equity shares on the final day of bidding.The retail quota, which is 35 percent of the issue, has seen a 54 percent subscription.

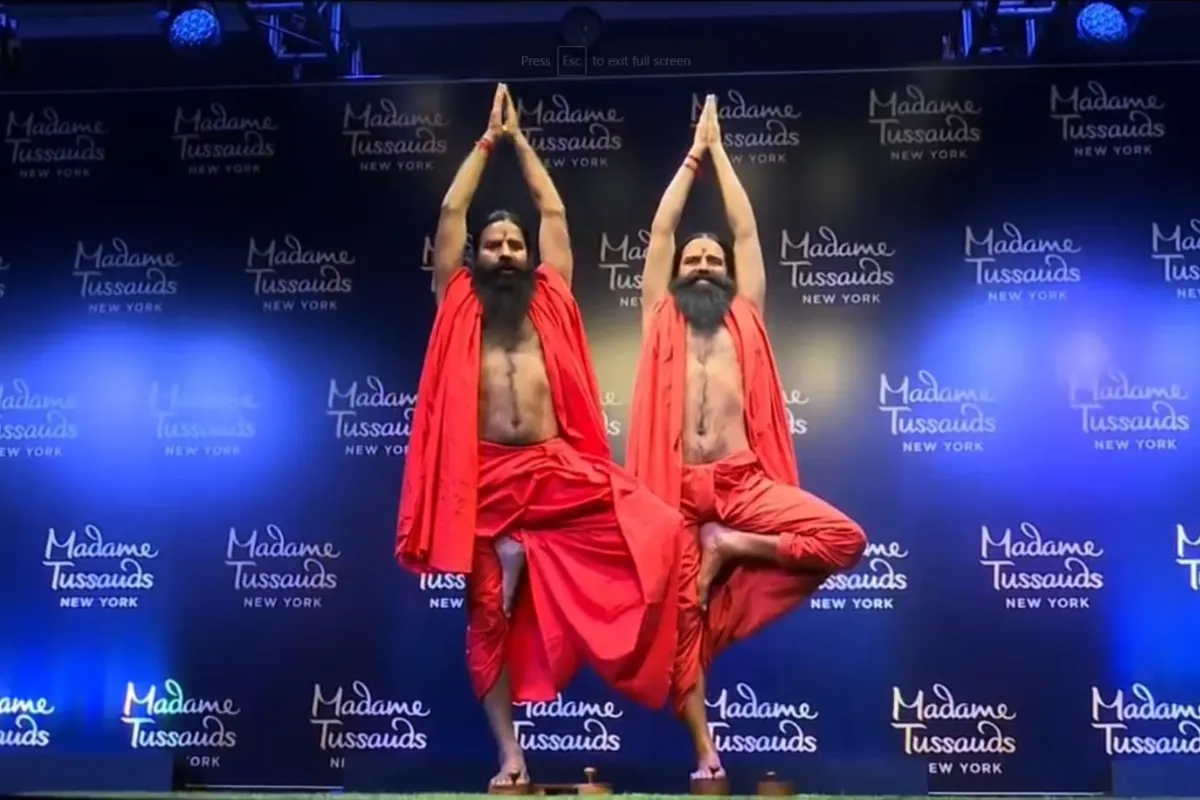

Meanwhile, earlier Baba Ramdev has announced his ambition to make edible oil company Ruchi Soya a “global brand”. Ramdev said that the company is strengthening itself at the village level in India while also strengthening its global reach.

Also Read – Manish Sisodia Presents Budget

Selling dominated the shares of Ruchi Soya on the BSE. The company’s shares closed at Rs 910.10, down by Rs 94.35, or 9.39%, today. Shares had reached their highest high of Rs 948.70 and lowest at Rs 831 in the day’s trading.

Know 8 things about the issue –

- The FPO was opened for subscription on Thursday, March 24, 2022 and will close on Monday, March 28, 2022.

- The company has fixed a price band of ₹ 615 to ₹ 650 per share for its follow-on public offer.

- Equity shares will be issued in this issue for a total amount of ₹4,300 crore. It has a reserve of 10,000 equity shares for eligible employees.

- Under the issue, the offer allocation shall not exceed 50% to the eligible institutional buyers. For Non-Institutional Bidders there will be an offer allocation of not more than 15% and for retail investors an offer of less than 35% is available for allotment.

- Companies like SBI Capital Markets Limited, Axis Capital Limited and ICICI Securities Limited are the Book Running Lead Managers of the issue.

- At present, Patanjali holds 98.9% stake in Ruchi Soya, while public shareholders hold 1.1%. After the FPO, Patanjali’s stake in the edible oil company will come down to 81 per cent, while the public stake will increase to 19%.

- In 2019, Patanjali bought Ruchi Soya through an insolvency process for Rs 4,350 crore. Ruchi Soya primarily deals in oilseeds processing, refining crude edible oil for use as cooking oil, manufacturing of soya products and business of value added products.

For all the news update subscribe our YouTube channel ‘DNP India‘. You can also follow us on FACEBOOK, INSTAGRAM and TWITTER.