RBI Monetary Policy June 2024: The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) is essential in determining the direction of the country’s economy. The repo rate, or benchmark interest rate, is decided by this six-person council. Bank borrowing costs are directly impacted by the repo rate, and this has an effect on the interest rates that consumers and companies pay on loans.

Maintain, Increase or Decrease the Repo Rate?

All eyes will be on the potential policy announcements made by the RBI during its second bi-monthly meeting of the fiscal year, which is taking place from June 5 to June 7, 2024. June 7, the last day, will see the outcomes, including the official policy decisions.

The MPC faces three main options:

- Maintain the Repo Rate: Keeping the rate steady to balance current economic conditions.

- Increase the Repo Rate: A move to control inflation by making borrowing more expensive.

- Decrease the Repo Rate: A strategy to stimulate economic growth by making borrowing cheaper.

Why These Decisions Matter

The Indian economy is greatly impacted by the choices taken by the MPC. The MPC works to maintain inflation within a government-established target range by modifying the repo rate. Reduced interest rates encourage borrowing and investment, both of which boost the economy. Higher rates, on the other hand, can limit borrowing and expenditure and therefore help manage inflation.

The stability of the whole financial environment is aided by the MPC’s actions, which are crucial in controlling credit flow and liquidity within the financial system.

Expectations for the June 2024 Meeting

The benchmark repo rate of 6.5 percent is expected to be maintained by the MPC, according to economists. Inflation management and the objective of promoting economic growth are seen to be balanced by this choice. It will also be closely monitored to see how the RBI positions itself on the “accommodation withdrawal,” since this might point to future changes in interest rates.

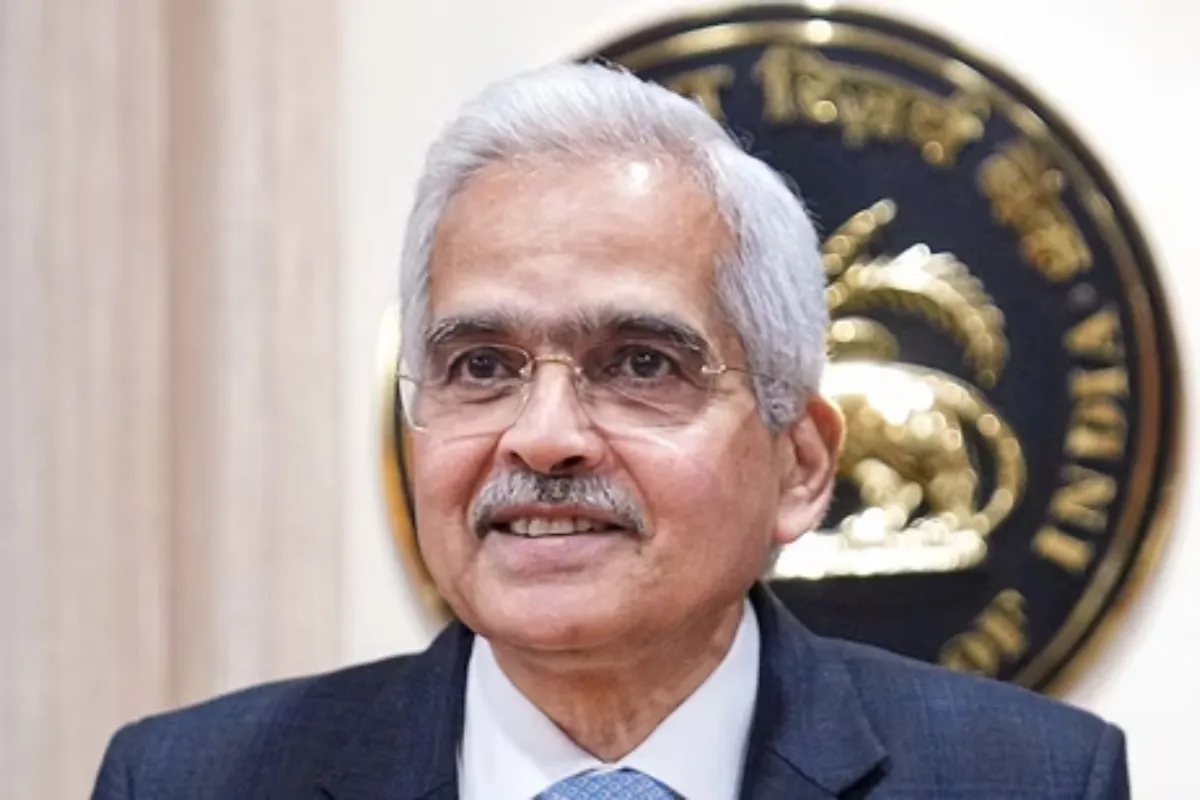

The MPC Panel: Who Are They?

The RBI Governor presides over the MPC, which consists of three external members and RBI representatives:

- Governor of the Reserve Bank of India — Chairperson

- Deputy Governor of the Reserve Bank of India, in charge of Monetary Policy — Member

- One officer of the Reserve Bank of India nominated by the Central Board — Member

- Prof. Ashima Goyal — Professor, Indira Gandhi Institute of Development Research

- Prof. Jayanth R. Varma — Professor, Indian Institute of Management, Ahmedabad

- Dr. Shashanka Bhide — Senior Advisor, National Council of Applied Economic Research, Delhi

Keep watching our YouTube Channel ‘DNP INDIA’. Also, please subscribe and follow us on FACEBOOK, INSTAGRAM, and TWITTER