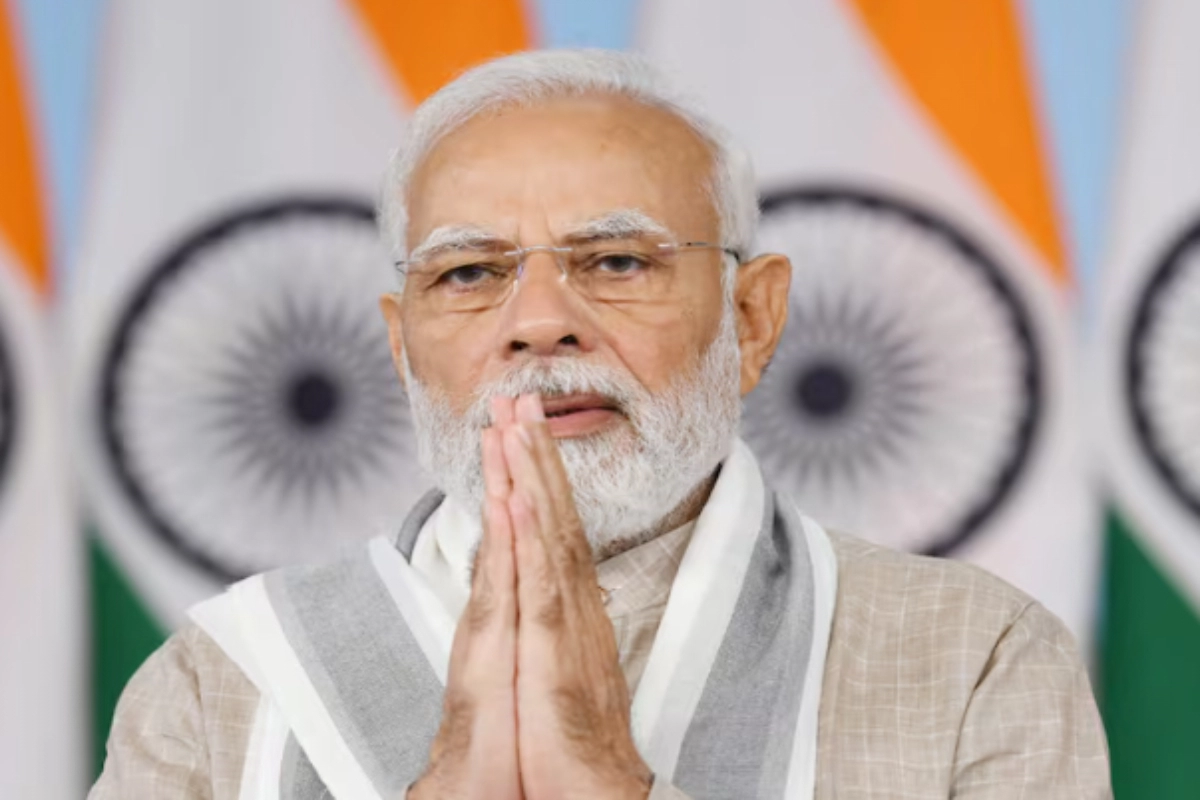

In a landmark move, the Insurance Regulatory and Development Authority of India (IRDAI) has greenlit the establishment of Bima Sugam—an innovative online insurance marketplace aimed at simplifying the insurance journey for all stakeholders. This paradigm shift, outlined in the “Regulatory Revamp: A Paradigm Shift” press note released on March 22, 2024, underscores IRDAI’s commitment to fostering universal access to insurance while safeguarding policyholders’ interests.

Unified Platform for Seamless Transactions

Bima Sugam acts as a virtual marketplace where insurance companies converge to offer their diverse range of life and non-life insurance products under one digital roof. From policy purchase to renewals, claim settlements, and grievance redressal, Bima Sugam promises an end-to-end digital experience for policyholders, ushering in transparency, efficiency, and collaboration across the insurance value chain.

Efficiency through Integration

Bima Sugam is like a one-stop shop for insurance stuff. It connects with government databases, insurance companies, and others, so you can easily check your details, find out about different insurance products, and do insurance stuff smoothly. It helps customers, middlemen, and agents work together easily, making it simple to buy different kinds of insurance policies like life, health, and non-life insurance.

Simplifying the Insurance Journey

Gone are the days of cumbersome paperwork associated with traditional insurance channels. Bima Sugam eliminates the need for physical documents, offering policyholders the convenience of storing policies in electronic format. Soft copies of purchased policies are readily available through electronic insurance accounts, simplifying document management for both new and existing customers.

Centralized Policy Management

With Bima Sugam, customers bid farewell to the hassle of managing multiple policies separately. All life, health, and non-life insurance policies can be conveniently accessed and managed through a single application or window, providing a comprehensive overview of one’s insurance portfolio.

Affordable and Transparent Insurance

Bima Sugam aims to make insurance more affordable by reducing intermediary commissions typically associated with traditional insurance channels. By directly selling policies through the platform, insurers can potentially offer lower premiums, thus benefiting policyholders. Moreover, the platform promotes transparency and affordability by offering discounts on premium rates for policies purchased directly through Bima Sugam.

Looking Ahead

Bima Sugam heralds a new era in the Indian insurance sector, akin to the transformative impact of UPI in banking. As a one-stop solution for selling, servicing, and settling insurance claims, backed by regulatory credibility, Bima Sugam promises enhanced accessibility and affordability of insurance products. While the platform’s launch is eagerly anticipated, its potential to empower both insurers and customers alike is bound to reshape the insurance landscape in India.