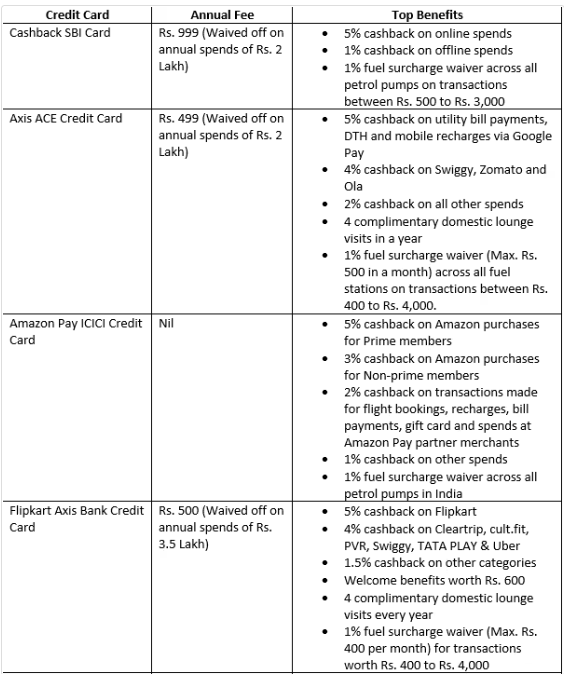

Cashback Credit Cards: Cashback credit cards are a great way to reduce your regular spending because they give you cashback on every purchase you make. Cashback is a percentage of the amount you pay that is charged on your credit card. While some credit cards provide a fixed cashback rate for all purchases, others offer a higher rate for particular purchases or categories. Whether you use your credit card for online or grocery shopping, you can get cash back on the areas where you spend the most.

Flipkart Axis Bank Credit Card

One of the greatest co-branded credit cards in India is the Flipkart Axis Bank Credit Card, which is ideal for frequent Flipkart shoppers because it offers 5% cashback on all purchases made on the designated platforms. Additionally, get 4% cashback at other retailers like Cure, PVR, Uber, and ClearTrip.Fit is also available.

Comprehensive Coverage

The three extremely popular categories—shopping, travel, and lifestyle—are all covered by the card. Comparable cards, such as Amazon Pay, have excellent advantages on their own marketplaces as well as with select partner retailers. The ICICI Credit Card with Amazon Pay provides the best rewards for your Amazon purchases. There is no enrollment or yearly fee for Amazon Prime members, who can receive 5% cashback on their purchases. However, non-prime members are still eligible for 3% cashback on Amazon purchases. In addition to cashback, this credit card comes with dining benefits, a waiver of fuel surcharges, and no-cost EMI options. If you are looking for a card that offers benefits on online shopping and you frequently shop at Amazon, this is a good choice.

Swiggy HDFC Bank Credit Card

Another popular choice is the HDFC Bank Credit card from Swiggy. A one-time joining fee of Rs 500 is waived upon spending Rs 2 lakh annually. Among the card’s salient characteristics are:

- 10% cashback on Swiggy, which includes Dineout, Instamart, Genie, and food ordering

- 5% cashback on purchases made online at participating retailers

- Cash back of 1% on other purchases

- Gratitude three months Membership for Swiggy One

Compared to other credit cards that offer cashback for shopping on their respective platforms, such as the Amazon Pay ICICI credit card or the Flipkart-Axis credit card, the Swiggy card offers a higher cashback rate of 10% on food, grocery delivery, and dining out.

With the right credit card, users can receive freebies, cashback, rewards, and complimentary memberships, which can result in significant cost savings. The best way for customers to take advantage of these advantages is to select a credit card that fits their spending habits.

SBI Credit Card

5% cashback is available on all online transactions made with the Cashback SBI Card, regardless of the platform or retailer you use.For the accelerated earning category, the maximum cashback limit is Rs 5,000 in a billing cycle. This means that online transactions up to Rs 1 Lakh per month are eligible for the additional earnings. All transactions after this monthly cap will earn you 1% cashback.

Reward Points and Cashback with HDFC Moneyback Credit Card

You can accrue reward points and cashback on your purchases with the HDFC Moneyback credit card. The good news is that you can turn your reward points into cashback, which is an uncommon feature that most basic credit cards do not offer. 10% accelerated cashback is available on all dining, food delivery, and grocery purchases made with an HSBC Cashback Credit Card (up to Rs 1,000 per billing cycle). The Rs 999 annual membership fee will be reimbursed if your annual spending surpasses Rs 200,000.

5% Cashback on Bill Payments and Google Pay Recharges

You can earn 5% cashback on bill payments and Google Pay recharges with the Axis Bank Ace Credit card in addition to 4% cashback on Swiggy, Zomato, and Ola. 2% cash back is awarded for all other costs. Additionally, all petrol stations waive the 1% fuel surcharge, and more than 4,000 partner restaurants offer discounts of up to 20%. By returning a portion of your purchases as cash rewards, cashback credit cards allow you to save money on your purchases. It’s similar to receiving a discount on each purchase. With these cards, you can accrue rewards on particular categories—like groceries, gas, restaurants, or utility bills—where you spend the most money.

Keep watching our YouTube Channel ‘DNP INDIA’. Also, please subscribe and follow us on FACEBOOK, INSTAGRAM, and TWITTER.