Income Tax News: Navigating through income tax notices can be daunting for salaried individuals in India. The Indian income tax department issues six types of notices to assess and rectify discrepancies in tax filings. It’s crucial for individuals to comprehend the implications of each notice, adhere to specified response time limits, and understand the reasons behind their issuance.

Section 143 (1) Notice: Intimation Notice

This notice, colloquially known as an intimation notice, arrives after the processing of Individual Tax Returns (ITR). Issued within nine months from the end of the financial year, it informs individuals about the alignment or mismatch between their calculations and the tax department’s assessment. If there is a tax demand, individuals are required to respond within 30 days from the notice issuance.

Section 139(9) Notice: Defective ITR

Issued within nine months from the end of the financial year, this notice is triggered when errors are identified in the filed ITR. Common reasons include discrepancies in House Rent Allowance (HRA) claims or unreported income. Individuals must rectify these errors by filing a revised ITR and respond within 15 days from the notice issuance.

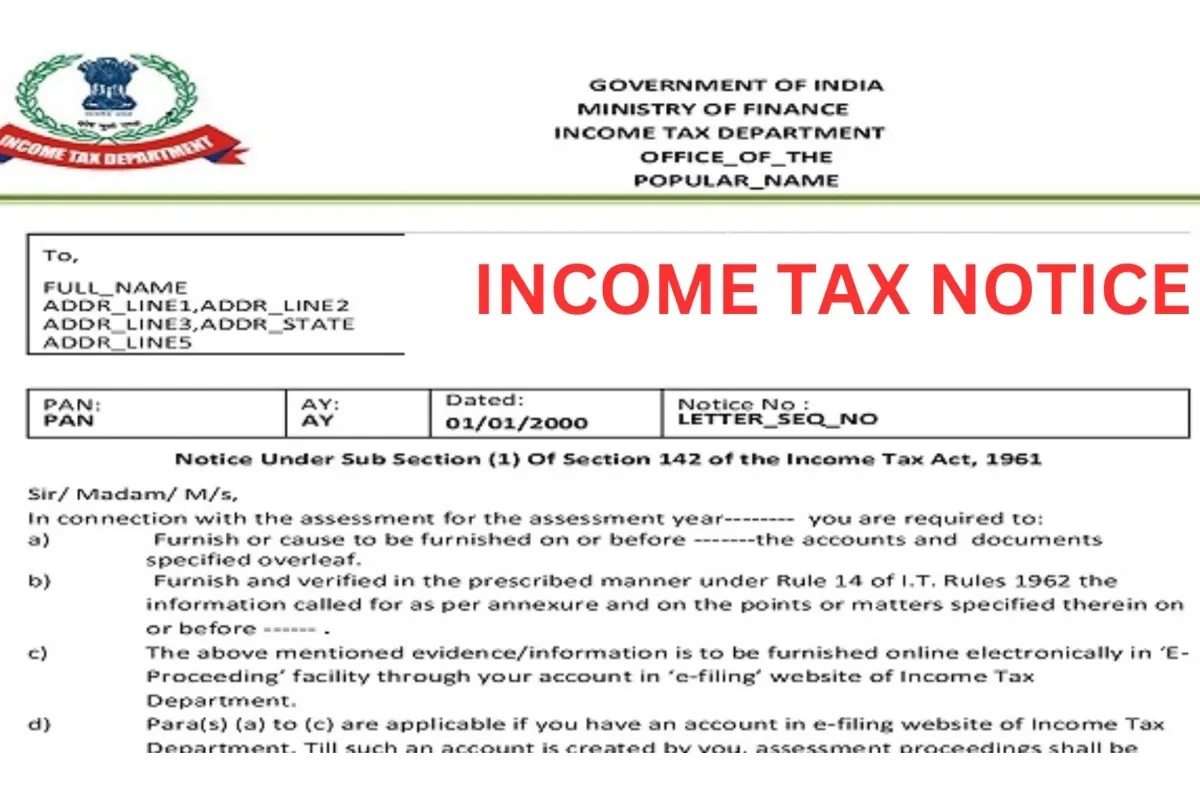

Section 142 Notice: Inquiry Before Scrutiny Assessment

There’s no maximum time limit prescribed for the issuance of this notice. The income tax department issues it to inquire why an ITR was not filed despite the individual’s earnings exceeding the basic exemption. Individuals must respond within the timeframe specified in the notice, typically around 15 days.

Section 143 (2) Notice: Scrutiny Assessment

If an ITR has been selected for scrutiny, this notice can be issued within three months from the end of the financial year. It involves a detailed assessment of the ITR, verifying the accuracy of claimed incomes and deductions. Responding is an online process, and individuals must do so by uploading necessary documents. The response time limit is usually 15 days from the notice issuance.

Section 148 Notice: Income Escaping Assessment

Issued when the assessing officer believes certain income has escaped assessment in the previous year, individuals receive a show cause notice before reassessment. The time period for issuing this notice depends on the amount of income, with a response time limit of 30 days mentioned in the notice.

Section 245 Notice: Adjustment of Tax Payable with Refund Amount

This notice empowers the income tax department to set off income tax refunds against outstanding demands. Issued with no specific time limit, individuals typically have around 30 days to respond by providing evidence of payment or objecting to the proposed adjustment.

Keep watching our YouTube Channel ‘DNP INDIA’. Also, please subscribe and follow us on FACEBOOK, INSTAGRAM, and TWITTER