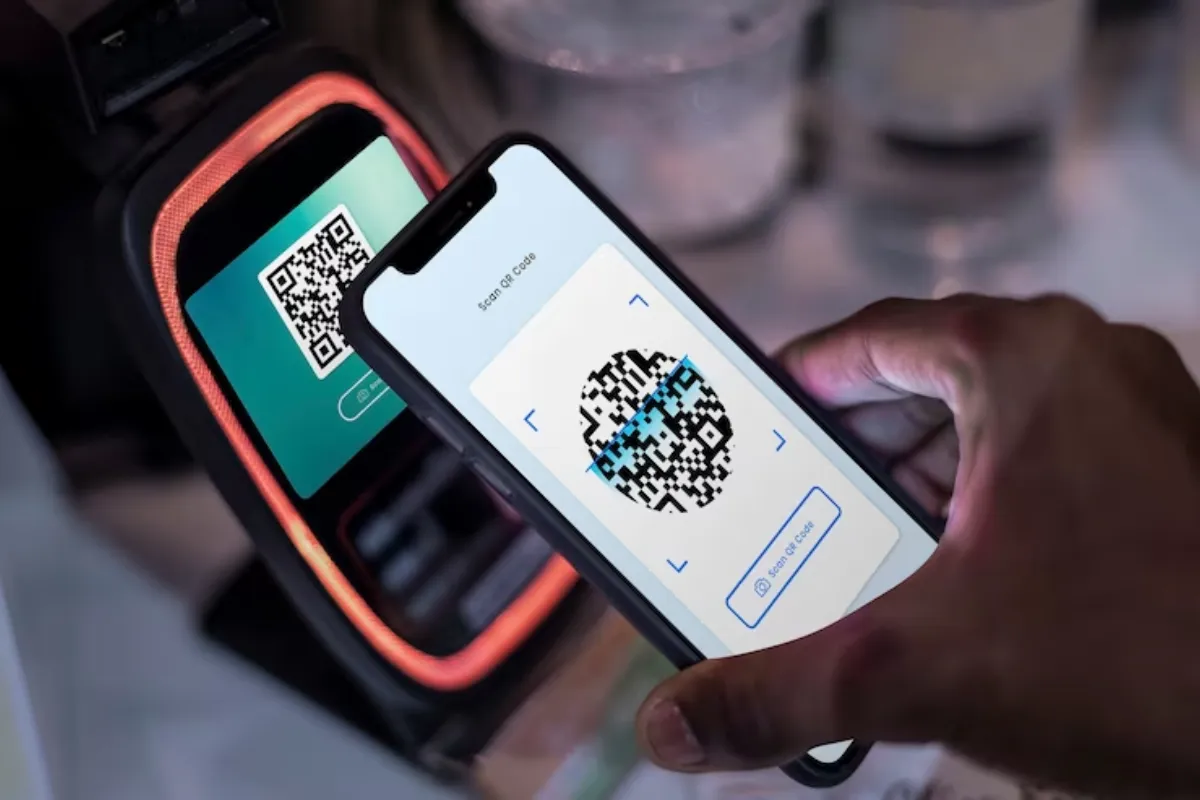

UPI: In the last few months Unified Payment Interface has witnessed an unprecedented growth. NPCI is dedicatedlly working to enhance digital payments experience of its users. Till now, there were no special benefits on UPI for credit card holders. But back sometime UPI enabled credit card holders to use their RUPAY credit cards for UPI payments, they can also scan UPI QR codes when paying with the credit cards via UPI.

But a large number of users are still hesistant to link their credit card with the Unified Payment Interface. If you are also one of them, this article is for you. Here, we will tell you 5 benefits of linking your credit card with UPI. Checkout more details below.

5 Benefits Of Linking Rupay Credit Cards With UPI

Instant Payments

A notable benefit of linking credit card with UPI is that it saves a significant amount of time whiile making transactions accounting to the UPI’s real time processing capabilities. It literally reduces time taken in credit card transactions and enhances the user experience.

Convenience

Linking your Rupay Credit card with UPI becomes a covenience in itself as it allows user to make transaction via a single platform instead of going to several other gateways for credit card transactions.

Finance Management

Linking Rupay Credit card with UPI will significantly help users to access their monthly spends which allows them to manage their budgets and track their payments. Customer can also set spending limits via UPI which will ultimately assist them limit their spends.

Cashback and Rewards

Whenever users make payment their card via UPI. They have a chance to win some impressive cashbacks and reward points. NPCI has ensured that users will get benefits of credit card payments on UPI.

Improved Online Shopping Experience

In India, a large proportion of users make purchases from e-commerce platform and its is now an integral element of consumer bahaviour in the country. Linking credit cards with UPI allows consumer to make instant payments with their Rupay Credit card.

Keep watching our YouTube Channel ‘DNP INDIA’. Also, please subscribe and follow us on FACEBOOK, INSTAGRAM, and TWITTER