Zerodha, established in 2010, has quickly ascended to become a major stockbroker in India. Their primary goal is to eliminate barriers hindering trading and investment activities by providing cost-effective solutions and leveraging advanced technology. Boasting a substantial clientele of over 1 crore, Zerodha actively contributes to a significant portion of Indian retail trading volumes.

On the other hand, HDFC SKY is a financial platform strategically designed to streamline and consolidate all investment portfolios. In response to the escalating retail participation in Indian markets, HDFC Securities launched Sky, a discounted broking app tailored to meet the evolving needs of investors. HDFC SKY seeks to simplify the investment process and enhance accessibility to financial opportunities.

Account Opening Process

Zerodha

To open an account with Zerodha, you can visit signup.zerodha.com and follow the instructions. The required documents include PAN card copy, Aadhaar card, mobile number linked to Aadhaar, bank proof, and income proof for F&O trading.

HDFC SKY

HDFC SKY offers account opening process through a mobile number signup. Further details can be completed through neccessary documents required.

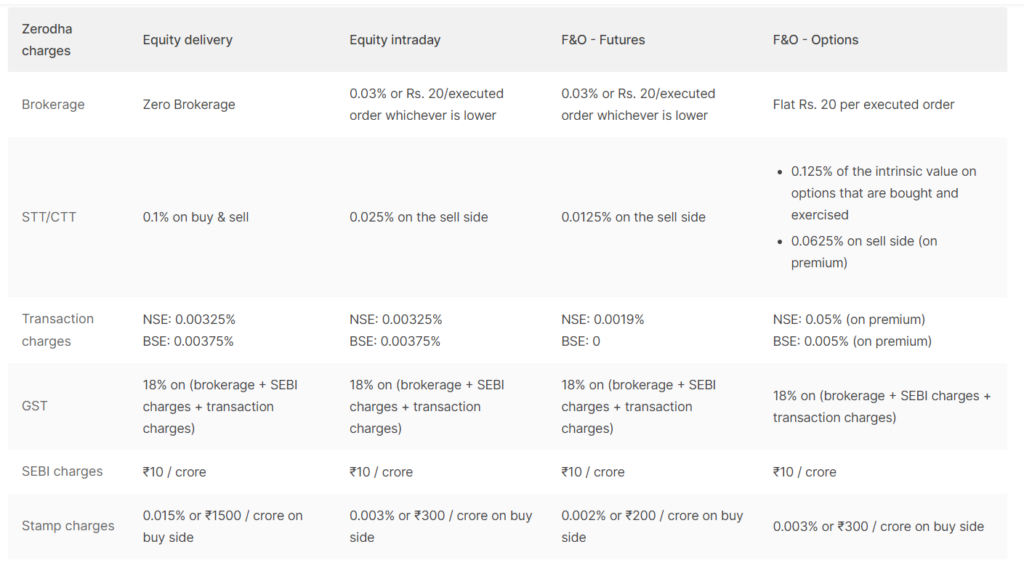

Brokerage Charges

Zerodha

Zerodha offers free equity delivery investments (NSE, BSE) with ₹20 or 0.03% (whichever is lower) per executed order on intraday trades. For options trades, the charge is ₹20 flat per trade. Direct mutual fund investments incur no commissions and DP charges.

HDFC SKY

HDFC SKY also waives maintenance charges for the initial year, further reducing the financial burden on new users. When it comes to trading, whether it’s Intraday or Delivery for equity, F&O (Futures and Options), currency, or commodity, HDFC SKY applies a flat charge of ₹20 per order.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice, endorsement, or a recommendation of any particular security or investment strategy. Readers are encouraged to do their own research and consult with a qualified financial advisor before making any investment decisions. The author and the platform do not take any responsibility for any investment actions taken by the readers based on the information provided herein

Keep watching our YouTube Channel ‘DNP INDIA’. Also, please subscribe and follow us on FACEBOOK, INSTAGRAM, and TWITTER