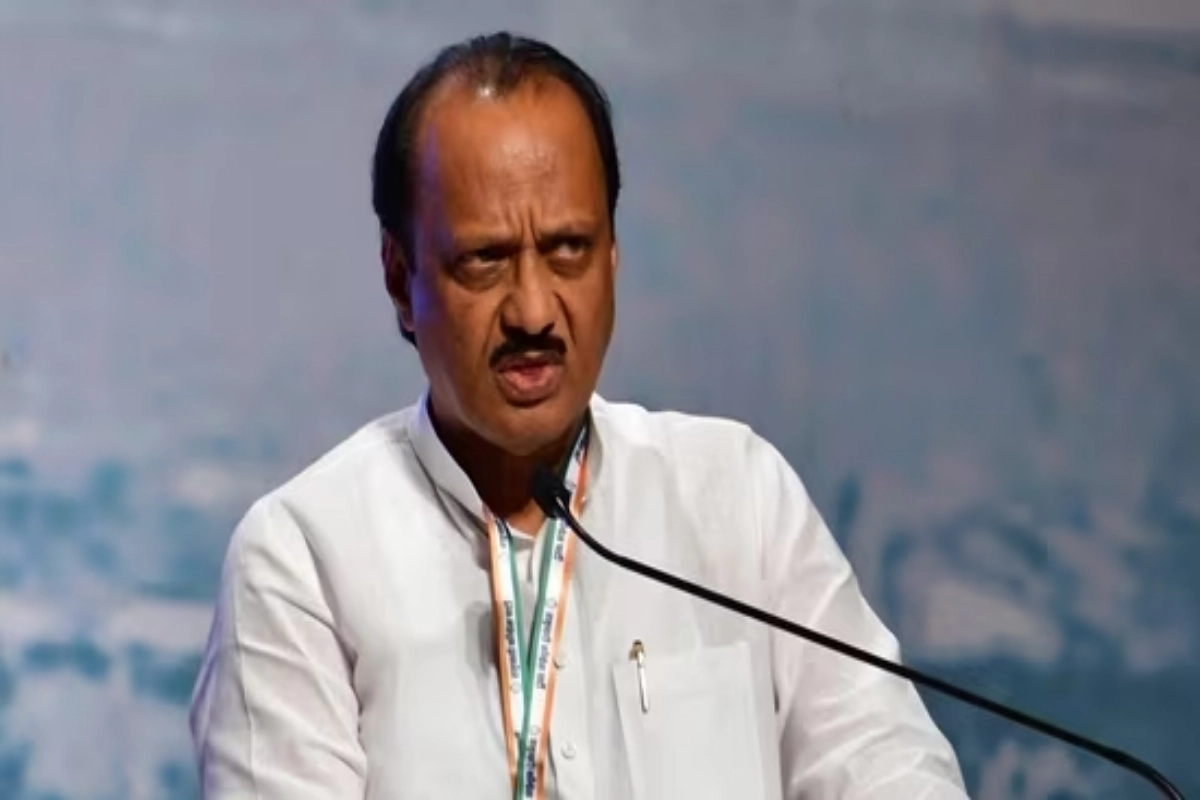

Ajit Pawar: A special court in Mumbai took notice of a chargesheet submitted by the Enforcement Directorate and stated that close friends of Maharashtra’s Deputy Chief Minister Ajit Pawar appeared to have purchased sugar cooperative assets “at a throwaway price.” One sugar plant that allegedly acquired unauthorised loans from cooperative banks is highlighted in the chargesheet, which the ED filed while Ajit Pawar was in the opposition.

Alleged Plot of Presenting Mills as Non-Performing Assets

The plan comprised presenting the sugar mills as non-performing assets, which were then sold at auction to political allies. It is believed that more than 50 sugar mills were mortgaged in this way, and then sold at auction. A special court in Mumbai summoned the businesses Guru Commodity Services Pvt Ltd and Jarandeshwar Sugar Mills Pvt Ltd as well as chartered accountant Yogesh Bagrecha, stating that “there are cogent, sound, and prima-facie sufficient grounds to direct issuance of process.”

Loan of Rs 826 Crore Points to Alleged Undervalued Purchase of Jarandeshwar SSK Ltd Assets

The loan of Rs 826 crore given by Pune District Central Cooperative Bank (DCCB) and other banks for the mortgaged property of Jarandeshwar SSK Ltd, according to the court, indicates that the assets were purchased by Ajit Pawar’s close associates at a throwaway price. According to the ED, a business founded with the same name as a plant called Jarandeshwar Sugar Mills engaged in criminal activity through conspiracy and shady financial transfers. According to the ED, Guru Commodity, a company situated in the city, acquired the factory at an unreasonably cheap price during an auction held by the Maharashtra State Cooperative Bank (MSCB), in which Ajit Pawar played a significant role.

Jarandeshwar SSK’s Valuation and Loans Raise Concerns

According to the ED’s inquiry, the MSCB auctioned off Jarandeshwar SSK in Satara in 2010 in accordance with the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act. From 1999 to 2000 and from 2002 to 2004, the factory ran smoothly. But as its financial situation worsened, Guru Commodity Services was given a lease. Jarandeshwar SSK acquired loans from the MSCB during this time. The court observed that, according to the MSCB, Jarandeshwar SSK was only valued at between Rs. 41.23 crore and Rs. 45.77 crore, despite having an outstanding loan of Rs. 487 crore and an overall loan of Rs. 826 crore against it.

Court Observes Shared Directors among Four Group Companies

The court noted that all four firms are group companies with the same directors after looking over the shareholders’ lists that the ED gave for each of the con companies. While the plant was first given to Jarandeshwar on a lease basis at a minimal fee, the assets of Jarandeshwar were nevertheless portrayed as having been purchased by Guru Commodity Services. Soon after, with Guru Commodity Services’ approval serving as loan collateral, Jarandeshwar mortgaged some of its assets and secured loans from the Pune District Cooperative Bank. The court declared after analysing the documents included with the Prosecution Complaint that they provided a classic illustration of how the scheduled offence can generate proceeds of crime.

Keep watching our YouTube Channel ‘DNP INDIA’. Also, please subscribe and follow us on FACEBOOK, INSTAGRAM, and TWITTER