UPI Scams: The Unified Payments Interface popular known as UPI has become a popular mode of payment in India, with millions of users making transactions daily. However, with its convenience comes the risk of falling prey to scammers and fraudsters. The National Payment Corporation of India (NPCI) has issued UPI Safety Shield Tips to help users protect themselves from potential threats.

One common UPI scam involves fraudsters sending money to unsuspecting victims’ accounts and then asking for it back, claiming it was a mistake. The victim, unaware that they have been scammed, ends up sending the money back, only to discover later that they have been defrauded.

How to Stay Safe?

- Firstly, users must only enter their UPI PIN when initiating a transaction to deduct money from their account. The UPI PIN is never required for receiving funds.

- Secondly, users must verify the recipient’s name before confirming the UPI ID. Refrain from making payments without proper verification.

- Thirdly, users must enter their UPI PIN solely on the dedicated UPI PIN page within the payment app. It is essential to keep your UPI PIN private from everyone.

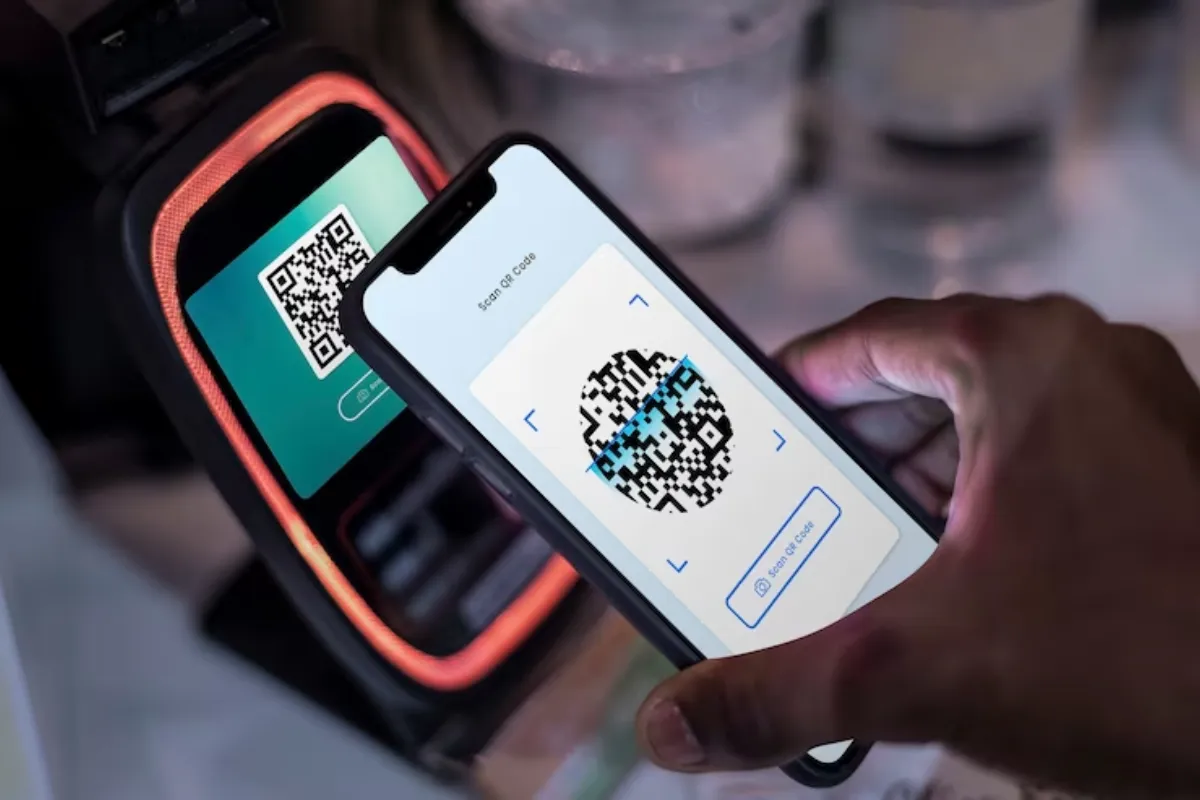

- You should use QR code scanning exclusively for making payments and not for receiving money. Ensure the legitimacy of the transaction before proceeding.

Additionally, we advise you not to download unnecessary apps, such as screen-sharing or SMS-forwarding apps without understanding their purpose. It is crucial to exercise caution and verify the necessity of such applications. Users must also understand the implication of UPI PIN entry which results in a deduction from their account.

Keep watching our YouTube Channel ‘DNP INDIA’. Also, please subscribe and follow us on FACEBOOK, INSTAGRAM, and TWITTER