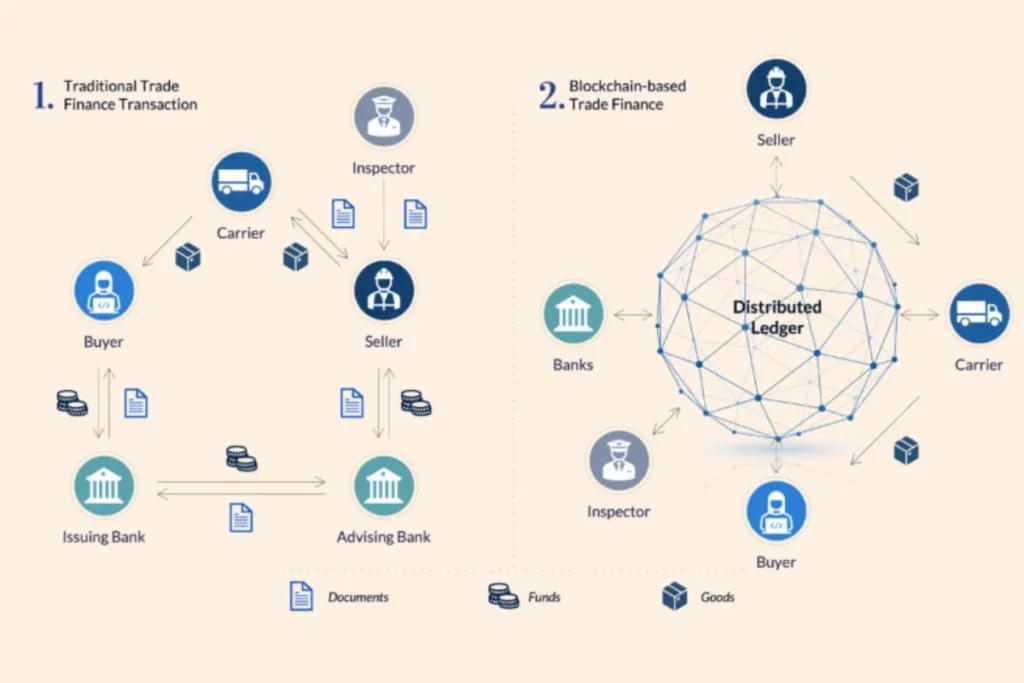

Blockchain Technology: Blockchain is a distributed ledger that works to record transactions in a secure and transparent manner. Blockchain technology has some great capabilities to ignite a revolution in the financial sector. It can help the financial sector by making it more secure, efficient and transparent. Blockchain technology can be used for different purposes in the Financial sector. Check out some of the major uses of Blockchain technology in the financial sector below.

Seamless Payments

One of the most promising uses of Blockchain technology in the financial sector is sending and receiving payments securely and cheaply. Blockchain technology can help to significantly reduce the charges of cross-border payments. It also eases the process of making big payments.

Trading

Blockchain technology can also be used for trading. It is capable of being used as trade securities such as stocks and bonds. Blockchain tech can significantly enhance the efficiency and transparency of trading processes. Along with making trading processes easy, Blockchain can also make new types of securities such as tokenized securities and cryptocurrencies.

Insurance Sector

Blockchain technology can be also used to make insurance claims much more transparent and efficient. It can revolutionize the insurance sector by offering a secure and transparent record of insurance claims and policies. Hence, it can work to significantly reduce the cost of insurance. Additionally, blockchain technology can also make new types of insurance such as parametric insurance which are much more efficient than traditional insurance.

Lending

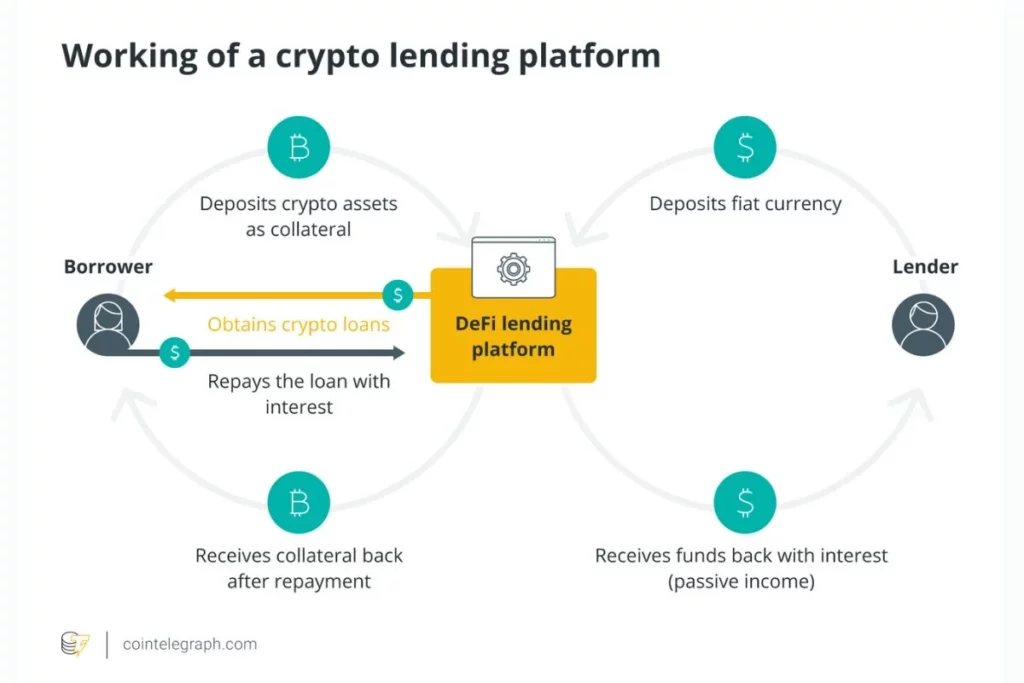

Blockchain technology can also prove helpful in making loans more secure, transparent and secure. This technology can provide secure and reliable data on the borrower’s creditworthiness. Along with this, blockchain is also capable of making new types of loans which include Peer-to-peer loans which are direct transactions between borrowers and lenders. Thereby, it can also significantly reduce the interest rates and overall costs of taking loans.

Compliance

Blockchain technology is also capable of being used to increase efficiency in compliance in line with the regulations. Because this technology can provide a more accurate and transparent record of transactions. As are result, Blockchain can also significantly lower the cost and effort financial institutes put into compliance.

Keep watching our YouTube Channel ‘DNP INDIA’. Also, please subscribe and follow us on FACEBOOK, INSTAGRAM, and TWITTER.