India’s cutting-edge Unified Payment Interface (UPI) sets sail to Sri Lanka and Mauritius, spearheading a digital revolution across borders. On February 12, esteemed leaders from India, Sri Lanka, and Mauritius, including Prime Minister Narendra Modi, Sri Lankan President Ranil Wickremesinghe, and Mauritius Prime Minister Pravind Jugnauth, will converge in a virtual conference to herald the launch of UPI services in these two nations. This milestone event will witness the simultaneous rollout of India’s renowned RuPay card services in Mauritius, underscoring India’s commitment to bolstering digital infrastructure beyond its borders.

More than just a transaction, a new era of connectivity

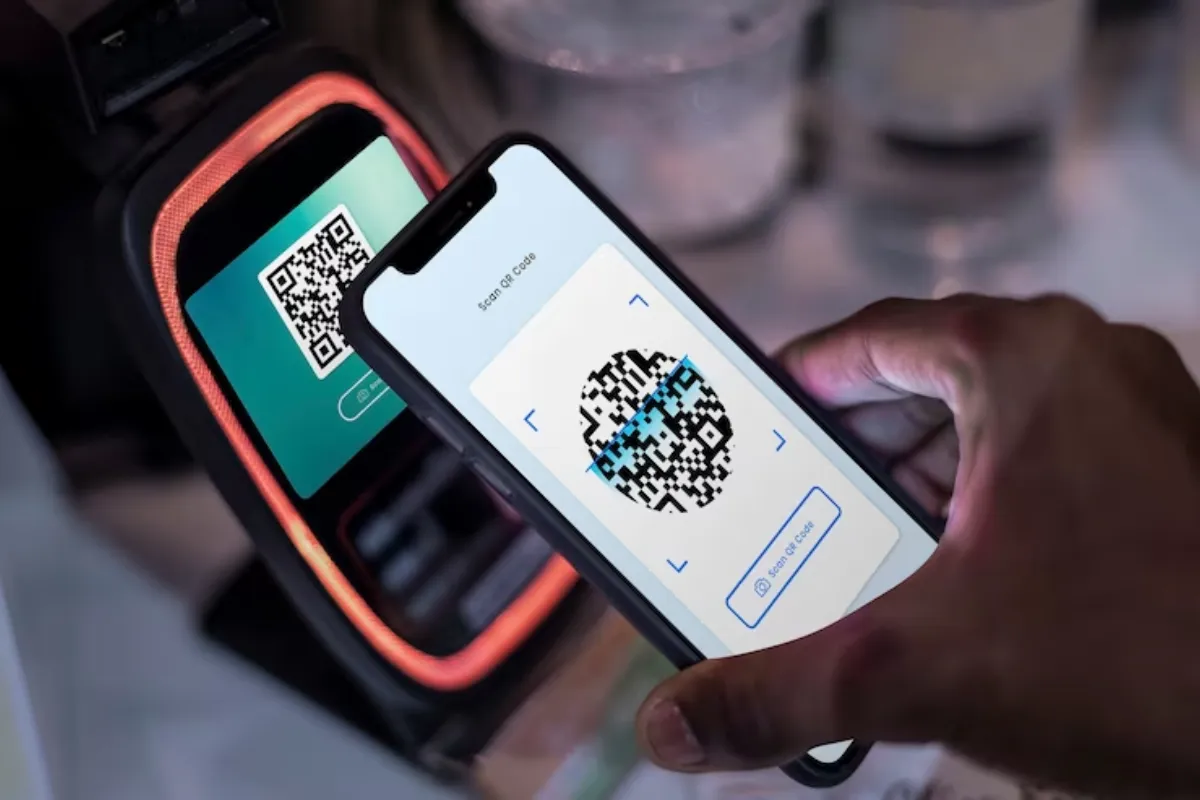

This isn’t just about seamless cashless payments anymore. The launch of UPI in Sri Lanka and Mauritius aims to revolutionize digital connectivity between these nations. Imagine Indian tourists in Sri Lanka effortlessly paying for souvenirs using their smartphones, or Mauritian students in India making quick and secure bill payments – all thanks to UPI’s magic!

Beyond UPI: RuPay joins the party!

But wait, there’s more! As part of this landmark collaboration, India’s indigenous RuPay card services will also be launched in Mauritius. This means Mauritian banks can now issue RuPay cards, allowing their citizens to experience the convenience of RuPay transactions not only in India but also within Mauritius itself.

Building bridges, one transaction at a time

Bhutan paved the way in 2021 by adopting UPI, and since then, this innovative platform has found its way to several countries like Oman, UAE, Nepal, and even France. This expansion not only benefits travelers and facilitates business transactions but also strengthens cultural and economic ties between participating nations.

Keep watching our YouTube Channel ‘DNP INDIA’. Also, please subscribe and follow us on FACEBOOK, INSTAGRAM, and TWITTER.