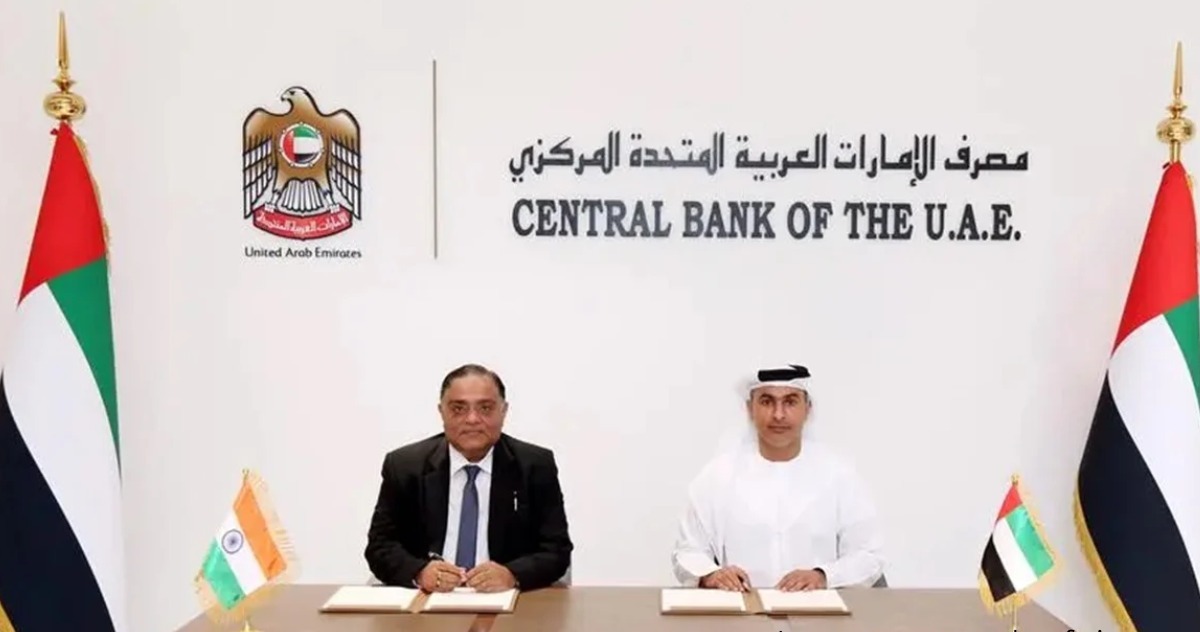

PM Modi UAE visit: The Reserve Bank of India has signed 2 Memorandum of Understanding (MoU) with Central Bank of UAE amidst PM Modi’s single day visit to the Gulf Nation. The first MoU seeks to establish a Framework to Promote the Use of Local Currencies for Cross-border Transactions while the second one concerns cooperation in terms for interlinking payment of India’s UPI with UAE’s Instant Payment Platform (IPP). The MoU was signed between RBI Governor Shaktikanta Das and Khaled Mohamed Balama, the governor of the Central Bank of the UAE.

The RBI issued a statement in which it was stated that Local Currency Settlement System is aimed towards promotion of Indian Rupee. “The MoU on establishing a framework for the use of local currencies for transactions between India and the UAE, aims to put in place a Local Currency Settlement System to promote the use of INR (Indian rupee) and AED (UAE Dirham) bilaterally” the statement by RBI. It was also added that MoU concerns all current account transactions and permitted capital account transactions.

PM Modi hails signing

PM Narendra Modi who is on a visit to UAE has hailed the agreement reached via signing of MoU’s and has described it as “a very important aspect of India-UAE cooperation.” He further added that it pave the way for improvements in economic partnership and will make international transactions much easier.

“This arrangement would also promote investments and remittances between the two countries. Use of local currencies would optimise transaction costs and settlement time for transactions, including for remittances from Indians residing in UAE,” the RBI said in a statment.

UPI-IPP linking

The two central banks would also link their Fast Payment Systems, Unified Payments Interface (UPI) of India with Instant Payment Platform (IPP) of the UAE. The RuPay will aslo be linked with UAESWITCH. This would make way for easy financial transactions and acceptance of cards in each other’s country.

The RBI has said that “The UPI-IPP linkage will enable the users in either country to make fast, convenient, safe, and cost-effective cross-border funds transfers.”

The Central Bank of UAE has said that after linking of Card switches there will be mutual acceptance and usage of cards while linking of messages will facilitate financial transaction messaging between India and UAE.

Keep watching our YouTube Channel ‘DNP INDIA’. Also, please subscribe and follow us on FACEBOOK, INSTAGRAM, and TWITTER.